TRANSFER DUTY DOWN: HOW MUCH WILL YOU SAVE?

How will you (and the property market generally) benefit from the proposal in Budget 2011 to reduce transfer duty?

First, the details -

1.The reduction will apply to all property sales on or after 23 February 2011

2.No transfer duty is payable when VAT applies to a sale

3."Non-natural" persons (companies, close corporations, trusts etc), which used to pay transfer duty at a flat rate of 8%, will now enjoy the same exemption threshold and reduced rates as individuals - making it more attractive to hold property in such entities (but only where appropriate in your particular circumstances - take advice on that first!)

4.The exemption threshold increases from R500.000 to R600.000

5.From R600.001 to R1.000.000, the rate is now 3% (last year - 5% from R500.001 up)

6.From R1.000.001 to R1.500.000, the rate is now R12.000 + 5% (last year - R25.000 + 8%)

7.From R1.500.001 up, the rate is now R37.000 + 8% (last year - R65.000 + 8%)

That's great news, particularly for property investors and first-time buyers, and thus for the property market generally.

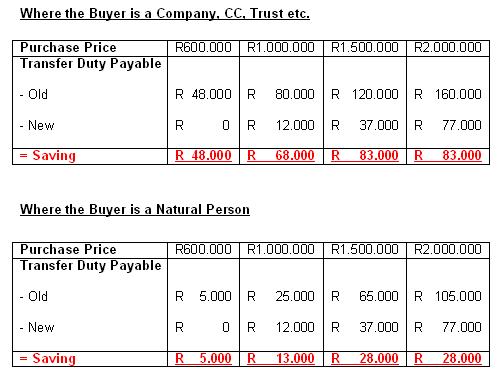

Your savings will look like this: -

THE NEW COMPANIES ACT - CAN YOU STILL TRADE USING YOUR CLOSE CORPORATION?

Close corporations have always been popular with smaller enterprises, combining the advantages of incorporation with lower costs and simpler administration than applies to companies.

However no new CCs can be registered - and companies can no longer be converted to CCs - after the new Companies Act comes into effect shortly (at date of writing, it's not clear whether or not the current deadline of 1 April 2011 will be met).

Good news here is that -

All the advantages that CCs had will now be found in the new 'Private Companies', and

Existing CCs live on - and can carry on trading indefinitely - until deregistered, dissolved, or converted into a Private Company.

In next month's issue, we'll look at the question of whether or not your company or CC will require an audit.

LIQUIDATION APPLICATIONS: SPURIOUS DEFENCES DISALLOWED!

Applying for the liquidation of a corporate debtor can be a powerful debt-collecting and/or damage-limitation tool - there is nothing like the threat of liquidation to concentrate a director's attention on the need to settle your claim! But a liquidation application is not appropriate (and indeed risks a punitive costs order against you for an "abuse of process") where the amount claimed has been disputed by the debtor.

So what do you do when - as all too often happens with a desperate debtor - a spurious dispute is raised, solely to keep you at bay? To what extent should you allow that to put you off applying for liquidation?

Guidance in this regard comes from a recent High Court decision confirming that, once it is shown that the monies in question are clearly owed, the onus then shifts to the debtor to demonstrate that the claim is being disputed both: -

"Bona fide" (i.e. in good faith, it must be "a genuine dispute"), and

"......on reasonable grounds".

The Court in this instance granted a final liquidation order against the debtor company, being unimpressed by the defences it had raised - in particular its assertion that other companies in its group would have adequate funds to meet the claim.

WHAT'S IN A (TRADING) NAME? PREPARE NOW FOR THE NEW RULES

Individuals and corporates have always traded freely under a variety of trading names (e.g. XYZ (Pty) Ltd trading as "Pablo's Plumbers"), but now for the first time - courtesy of the Consumer Protection Act - you will be forced to register all such trading names as "business names".

Registration will only be compulsory where a trading name is different to the name of the business owner, so you will still be free to trade under your own name (we're talking full name here, as recorded on your ID document) without registering it. Similarly, your company/CC/Trust etc may trade under its registered name. But where - as in the example above - the trading name differs from the owner's name, registration will be obligatory. It will be unlawful to trade, market or contract in any way under a non-registered name.

Note that, despite several alarmist reports to the contrary, there is no immediate hurry here - at the earliest these provisions will kick in one year after the main Act does (i.e. 1 April 2012 at the earliest), and after at least 6 months' notice from the Minister.

Plus there will be relief from these registration requirements in two circumstances: -

Where you have already registered a business name under existing legislation, and

Where you have been "actively conducting business" under the name for at least one year prior to commencement (i.e. for a year from 1 April 2011, perhaps later).

(You may want to voluntarily register these names anyway, just to get them onto a public database).

But don't wait for deadline! Your trading name is an integral part of the value of your business, so you should start planning now to comply with - and take advantage of - these new provisions: -

You will be able to register any number of "business names"

Names may be in "any language", and can include "any letters, numbers or punctuation marks", "round brackets" in pairs, and the symbols "+, &, #, @, %,=" (plus further symbols to be specified in regulations)

You won't be able to register any business name that is misleading, confusingly similar to any corporate name, trademark etc, or unlawful

Don't stop trading under any business name for more than 6 months - if you do, you risk losing it.

You won't be able to register your business names under the Consumer Protection Act until the applicable regulations have been promulgated. In the interim you may if you wish apply for "defensive names" under the Companies Act, which will at least get the names onto CIPRO's current database.

DEVELOPERS AND OBJECTORS - PROCEED WITH CAUTION!

New property developments must, if they are to obtain approval, comply with the ever-growing environmental protections built into our law, and conflict between developers and environmental activists is bound to become more and more common.

Both sides need to understand the rules of the game: -

Anyone objecting to a development should check that there are legally defensible grounds for doing so - otherwise an objector risks, amongst other things, being sued by the developer for (possibly substantial) damages

Developers on the other hand risk incurring the full wrath of our courts if they use litigation against objectors to intimidate or punish them - what's known overseas as "SLAPP" ("Strategic Litigation Aimed against Public Participation").

The danger to developers, if they are found to have instituted a SLAPP-type suit, is graphically illustrated in a recent High Court case where, having dismissed a developer's massive claims against four objectors for defamation and other damages, the Court further awarded costs against the developer on the punitive "attorney and client" scale - and that, no doubt, will be a huge bill.

This was widely regarded as a "test case" for the SLAPP concept in South Africa, and the Court's comment that our law's "concept of vexatiousness corresponds very closely with the features of a 'SLAPP' suit" serves as a particular caution to developers in their future handling of objections.

CORRUPT COPS: COURTS CRACK DOWN

The High Court recently confirmed sentences of 15 years' imprisonment imposed on each of two police officers convicted of corruption involving a R2,000 bribe.

The officers, trapped by the police anti-corruption unit after the complainant reported the matter to them, were, held the Court, "in a position of trust, which they violated". Police corruption, the Court said, ".....is a prevailing problem in our society and the courts are obliged to protect society against this threat to our democracy."

There's a clear message there for corrupt officials. And it's a hopeful one for their victims - us, the public.

THE APRIL WEBSITE: COMPANY HIJACKING - GET EARLY WARNING!

"Company hijacking" - fraudulent changing of directors and other company details in CIPRO's database - is in the news, and you should check regularly for any unauthorised activity.

You can do this yourself on CIPRO's website www.cipro.gov.za (that address will no doubt change when the new CIPC - Companies and Intellectual Property Commission - comes into being shortly).

Or you could opt for a free "early warning" system - register at www.companyalert.co.za for WinDeed's new monitoring and alert service "Company Alert", which offers the following: "You list the companies you're concerned about and we monitor them on a daily basis. We'll alert you if there are changes to the company status or directorships."

Have a great April!