SIGNED SURETY ON A BOND? MANAGE YOUR RISK!

“Buy land – they’ve stopped making it” (Mark Twain)

Property can indeed be a great investment, just be aware that signing personal suretyship – which you will almost certainly have to do if you buy property in a company or trust with money borrowed from a bank – carries risks that you can and should actively manage. Whilst the bank’s first line of security will be a bond over the property, its second will be you personally as surety.

And several recent court decisions illustrate just one of the dangers that you face – sale of the property under value.

Sale under value

Take this scenario - the company’s property is worth more than the bondholder’s claim, so you sleep soundly in the belief that your personal assets aren’t ever going to be at risk. But things go wrong and the property is sold for less than its true value. You are duly sued by the bondholder for its shortfall.

Can you escape your suretyship obligations if it is the bondholder that is responsible for the sale below value? The answer is yes - but only if you can prove that the property was indeed sold under value, that the bondholder prejudiced you by selling at that value, and that you didn’t contractually accept that risk.

So you are at risk if…..

If it wasn’t the bondholder who controlled the sale, but someone else.

Thus in one recent case, Mr. A as director of a company arranged a sale of its property for R3,3m, leaving the bondholder bank with a R2.5m shortfall for which it sued Mr. B as surety. B’s defence was that A had only been authorised to sell for no less than R3,85m, and that the sale at R3,3m was unlawful and well below market value - to B’s prejudice. Irrelevant, held the Court - even if the sale was at less than the minimum price authorised, that was a matter between A and B, it had no relevance to the bank’s claim. B had to pay under his suretyship.

In two other cases, the property-holding company had been liquidated, and the sales effected by the liquidators, not by the bondholders. In one case, a property allegedly worth R65m was sold for R30m, and the surety ended up having to pay the bank its R40m shortfall. In the other case, a property allegedly worth R15m was sold for R6.8m, leaving the surety liable for R7.2m. In both cases, the bondholder could not be held liable for the sale by the liquidator, the Court in the one matter specifically declining to find on the facts that the bank had “controlled and dictated the terms of the sale agreement.”

If you can’t prove the true value of the property.

This wasn’t a critical issue in any of the cases in question, but it probably isn’t going to be easy to show that a theoretical valuation should trump the actual sale price – “market value” at the end of the day is what a willing buyer will pay to a willing seller.

If the terms of your suretyship are such that you accepted the risk of a sale under value.

You are bound by the terms of what you sign. In one of the above cases the terms of the suretyship covered the bank regardless of "any negligence or breach of contract on the part of the Bank or the debtor, or the non-notification to the surety of any default, delay, omission or contractual breach on the part of the Debtor". Whilst the Court confirmed that “fairness and good faith are considerations which are deeply embedded in our law of contract”, if the prejudice complained of results from the bank acting in accordance with the terms of the loan agreement and the suretyship, then that is prejudice which the surety “undertook to suffer”.

Take advice upfront

By all means invest in property through a company, but be aware of the risks associated with signing surety, and manage them at all times – in particular seek legal assistance before signing anything, and again at the first sign of trouble in your company or trust.

FACEBOOK, TWITTER: POST AND TWEET AT YOUR PERIL! AND BEWARE, TRUTH ISN’T EVERYTHING

“I wonder too what happened to the person who I counted as a best friend for 15 years, and how this behaviour is justified. Remember I see the broken hearted faces of your girls every day. Should we blame the alcohol, the drugs, the church, or are they more reasons to not have to take responsibility for the consequences of your own behaviour? But mostly I wonder whether, when you look in the mirror in your drunken testosterone haze, do you still see a man?”

That’s the relevant portion of a Facebook post which the High Court recently ordered its author to remove, finding that she had acted out of malice. The judgment is an important one, breaking new legal ground and confirming that defamation is as much unlawful in the virtual world as it is in the physical one.

What can you safely say online?

In broad terms, publication of anything proved to be defamatory (damaging to another’s reputation) is presumed to be both intentional and wrongful. That puts the onus on you to prove lawful justification via one of the legal defences - such as “mistake”, “lack of intention”, “consent”, “fair comment”, “truth and public benefit”, or “privilege”.

Note in particular that just because something is true, that doesn’t entitle you to tell the world about it – if it is defamatory you must also show that it is “to the public benefit or in the public interest that [it] be published”.

The high cost of getting it wrong

You risk not only being interdicted and having to bear the resulting legal costs (as happened to the author of the post in this case); you could also face a claim for damages, and perhaps even criminal charges. And social media comes with a new and particular danger – once you post something online, it tends to live on in cyberspace forever. Anything that captures the online community’s attention will be re-posted, re-tweeted, and generally disseminated beyond any chance of recall. If it goes viral, the resulting damages claims could be massive.

Adjusting your privacy settings may give you a degree of protection, but there are no guarantees so rather err on the side of caution.

YOUR SMALL BUSINESS AND THE BUDGET: BIG BENEFITS FOR SOME

If your SME qualifies as a “Small Business Corporation” (SBC), you stand to benefit from new tax concessions announced in February’s Budget Speech.

First - is your business a “Small Business Corporation”?

To qualify as an SBC your business must be in a company, and it must meet the following (summarised – take advice on specifics) requirements –

Annual gross income not exceeding R20m (up from R14m - see below)

All shareholders must be natural persons i.e. individuals

Shareholders are limited in what other business interests they may hold

“Personal service providers” are excluded, and no more than 20% of gross income must come from investments or from rendering “personal services”

More tax relief

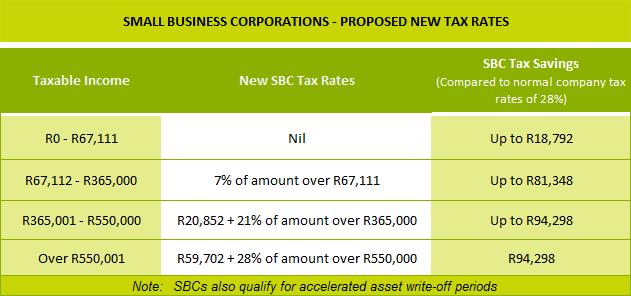

For many years SBCs have paid a lot less than the normal company tax rate of 28%, and now two new changes for the better have been proposed in the 2013/14 Budget -

The turnover threshold will increase from R14m gross income to R20m – a major boost for small business, and

The present SBC tax rate concessions (0% up to R63,556, then 7% up to R350,000, with the normal 28% kicking in over that) improve as per the table below –

The “turnover tax” option

As an alternative, if your annual turnover is R1m or less you could qualify for the simplified all-in-one “turnover tax” as a “micro enterprise”. Note that not only corporates qualify here – also sole traders, partnerships and trusts. If you qualify you could (a) save a lot of tax and (b) greatly reduce your admin burden. But turnover tax is actually a bad option for some businesses - take advice on your particular circumstances.

TENDER FRAUD - FIGHT BACK!

What are our courts doing about the scourge of tender fraud in South Africa?

The sentence: 3 years’ prison

It’s a hot topic yet again, and honest tenderers can take heart from the effective sentence of 3 years’ imprisonment recently imposed by the Supreme Court of Appeal on a man convicted of tender fraud relating to the Free State Education Department’s 2001 tender for the delivery of school books. A failure to disclose in the tender declaration that a person connected with the tenderer was employed by the province and married to an MEC in the provincial government was, the Court found, a fraudulent misrepresentation prejudicial both to other tenderers and to the community at large.

The Court held that the seriousness of the crime required a custodial sentence, despite the mitigating circumstances –

The personal circumstances of the fraudster (a 40 year old family man with 5 dependent children and no criminal record),

The relatively modest amount involved (R364,033), and

The fact that the department itself had suffered no monetary loss (the successful tenderer had given full value for its tender).

“Fraud in the procurement of state tenders” said the Court “is a particularly pervasive form of dishonest practice. It undermines public confidence in the government that awards tenders, apparently without regard for nepotism, and it creates perceptions unfavourable to the services provided pursuant to such tenders. It is proving notably difficult for the authorities to identify and root out such malpractices. The courts are obliged to render effective assistance lest the game be thought to be worth the candle.”

Report fraud!

So if you lose out on a tender as a result of fraud, know that our courts are on your side - fight back, report it!

REMINDER – COMPANIES, DON’T MISS YOUR “MOI” DEADLINE!

Don’t miss the 30 April 2013 deadline to bring your shareholder agreements and your company’s “MOI” (what used to be called your “Memorandum and Articles of Association” is now a “Memorandum of Incorporation”) into line with the new Companies Act. Take advice now if you aren’t sure what to do.

THE APRIL WEBSITE: 20 THINGS YOUR BURGLAR WON’T TELL YOU

“Know your enemy” (Sun Tzu)

Protect yourself and your family from crime - join your local Neighbourhood Watch, then educate yourself on how criminals work.

Start with Tony Schreiber’s “Twenty things your burglar won’t tell you” on his blog at:- http://tonyschreiber.blogspot.com/2012/07/twenty-things-your-burglar-wont-tell-you.html.

Have a Great April!

Note: Copyright in this publication and its contents vests in LawDotNews(law.news)