WHO'S LIABLE FOR YOUR LEAKING ROOF?

You buy your dream house, you settle in, all's well. Until it rains, and the roof starts leaking. Who's liable?

The law, and the limits to voetstoots

First, determine whether the leak problem is a latent defect, i.e. one that "would not have been visible or discoverable upon inspection by the ordinary purchaser".

Next, check the precise terms of the sale agreement. Standard practice is for property sellers to sell the property "as is", by contracting out of liability for latent defects with a voetstoots clause.

Note that a seller can never use a voetstoots clause to escape liability for any defect which he/she is actually aware of - deliberate failure to disclose a material defect is fraudulent.

Moreover, where the CPA (Consumer Protection Act) applies - and although current thought is that one-off private sales won't fall under the Act, you should take specific advice on this in need - the buyer's position is likely to be a lot stronger, perhaps even to the extent of voetstoots clauses losing all validity. There is also speculation as to the extent that estate agents risk liability in sales generally. (Note that the court case mentioned below arose before the CPA came into effect.)

Knowledge is key!

As an interesting case recently before the High Court neatly illustrates, the seller cannot be held liable for a latent defect of which he was unaware. The house in question had a thatched roof, and the seller had recently effected repairs to it to rectify several problems which had caused leaking previously - all of which he had disclosed to the buyer.

What's the perfect pitch for thatch?

After transfer, the roof again leaked, and a structural engineer specialising in thatched roofs told the buyer that the roof should be replaced rather than repaired, because its pitch was largely incorrect (his opinion as expressed in Court thereafter being that a pitch of 45° is to be recommended, whilst "a pitch below 30º cannot be regarded as functional").

The finding

The buyer sued the seller for a reduction in the purchase price, alternatively damages. Finding that the seller had not known of the relevant structural defect, i.e. the incorrect pitch of the roof, the Court upheld the seller's reliance on the voetstoots clause in the deed of sale, and dismissed the buyer's claim.ARMED ROBBERY! SUING YOUR SECURITY COMPANY

"PAY NOW, ARGUE LATER" - SARS 1, TAXPAYERS 0

"The only difference between a tax man and a taxidermist is that the taxidermist leaves the skin"

(Mark Twain)

SARS has wide powers to collect taxes from you, even when you are in dispute with it over the correctness of an assessment: -

Firstly, SARS can, without notice to you and without issuing summons, lodge with a court a statement of what it alleges you owe in taxes and/or interest, which statement will thereupon have the force and effect of a judgment against you.

Secondly, the "pay now, argue later" principle enables SARS to enforce payment of the amount it claims even when an objection or appeal by you is pending.

The High Court cases

That's pretty draconian, and, although there is international recognition of the need to give revenue collectors this sort of power when dealing with tax cheats, taxpayers with genuine disputes are perhaps entitled to feel more than a little aggrieved. There was relief therefore when the High Court in 2010 held that it was in fact not competent for SARS to have obtained judgment against a taxpayer in the face of a pending objection.

Regrettably, that hasn't lasted long. SARS has now won two further High Court cases on the same issue, and we revert to a situation where you just have to cough up when told to.

What you can do - the suspension application

There is however one way to reduce your immediate pain - apply to SARS to suspend your obligation to pay, pending determination of the dispute. In appropriate circumstances, you will be given relief; and SARS in considering your application will be guided by specific factors rather than exercising an undefined discretion.

Examples given by SARS of the factors to be considered in deciding on a taxpayer's request to suspend payment of a disputed debt are -

The compliance history of the taxpayer;

The risk of dissipation of assets during the period of suspension;

Whether the taxpayer is able to provide adequate security for the payment of the amount involved;

Whether payment of the amount involved would result in irreparable financial hardship to the taxpayer; and

Whether the objection or appeal is frivolous or vexatious.

DEBT REVIEW: IS IT AN ACT OF INSOLVENCY?

The sequestration option

When dealing with a recalcitrant debtor who is clearly just playing for time, sequestrating his or her estate might be your best course of action (take advice in doubt).

To succeed, you must prove -

That you have a valid claim against the debtor, and

That the sequestration will be to the advantage of creditors, and

That the debtor is indeed "insolvent".

Note that you don't need to prove actual insolvency - just that the debtor has committed an "act of insolvency".

The NCA - and the shifting of the onus

And, per a recent High Court case, a debtor who advises creditors that he has applied for debt review (or is under debt review) under the provisions of the NCA (National Credit Act) may thereby commit just such an "act of insolvency". The letter of advice will constitute a notice of inability to pay debts - which is an "act of insolvency" - if it would be so understood "by a reasonable person in the position of the creditor receiving the letter".

Critically, once you have proved an act of insolvency, the onus shifts to the debtor to convince the court that there are "very special considerations" why the sequestration order should be refused.

The Court, which retains a general discretion to grant or refuse any sequestration application, commented that "it is likely that realistic and bona fide debt re-arrangement proposals or debt re-arrangement orders may increasingly move courts to refuse sequestration orders in favour of such proposals which allow the debtor to survive financially whilst not unduly prejudicing creditors." But in this particular instance, the debtor had not shown any "special considerations", and his estate was sequestrated.

HOW TO LOSE 12% OF YOUR SALE PRICE (WITHOUT REALLY TRYING)

When you sell anything and the sale is subject to VAT, ensure that your agreement specifies clearly whether the agreed purchase price includes or excludes VAT.

VAT - and the deeming danger

If VAT isn't mentioned, the price is deemed to be inclusive of it. If that isn't what you intended, in other words if you anticipated the purchaser paying the VAT over and above the full purchase price, you are in for a disappointment. And a substantial loss - you will be liable for VAT at the "tax fraction" (which comes to 12.28% of the gross price).

You can of course try to override the deeming provision by proving that the actual intention - of both you and the buyer - was for the price to be VAT exclusive. But that's never going to be easy.

So who pays the taxman? The case of the dairy farmer, the tenant, and the option to purchase

Thus in a case recently before the Supreme Court of Appeal, the owner of a dairy farm had leased it to a tenant with an option to purchase the farm for "R700.000" - no mention of VAT. When the tenant exercised the option, he did so at a price of R700.000 including VAT. The owner argued that in fact the price was exclusive, and asked the Court to import an implied or tacit term to that effect into the option.

The Court declined to do so, and found against the owner - who now has to pay the VAT of R85,964 out of his R700.000 proceeds.

PAIA MANUALS: LAST-MINUTE REPRIEVE FOR SMALL BUSINESSES

The more delay'd, delighted. Be content" (Shakespeare)

Government has again extended the deadline for compilation and submission of PAIA information manuals. As happened in 2005, the extension was effected literally at the last moment, and without any apology to the many small businesses who rushed to comply in time.

Who gets the extension?

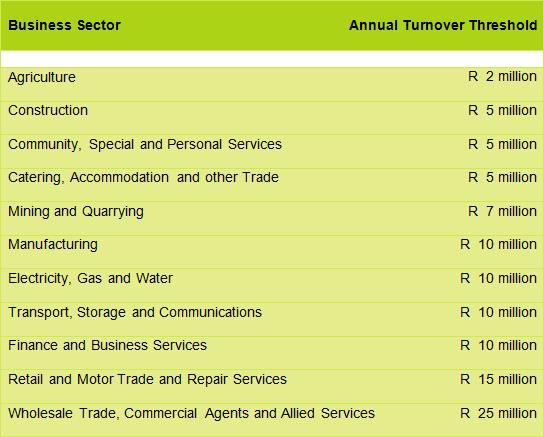

The new extension, now to 31 December 2015, applies to most smaller businesses - specifically to any "private body", including any private company, but not to any non-private company, nor to any private company in any of the business sectors listed below with either -

50 or more employees, or

An annual turnover of or above specific thresholds - see the table below for details.

(Note - if the table above does not display correctly, please see the "online version" - link above, under masthead)

If you are one of the many who did hurry to compile and lodge a manual last year, take comfort in the fact that sooner or later everyone will have to comply anyway. At least you've got it out of the way early!

THE FEBRUARY WEBSITE: FUTURE PLANNING - 2012 AND BEYOND

"The Times They Are a-Changin'" (Bob Dylan)

The Future - predicting it is never going to be easy, and with The Times a-Changin' even faster than when Dylan wrote his iconic song in the Sixties, scenario planning is becoming more and more challenging.

But still we have to do it - in both our business and private lives - which means having at least a rough idea of what's likely to be in store for us.

Here are two websites that might help. How accurate they will turn out to be is of course the big unknown, but they certainly are full of thought-provoking predictions. Perhaps there's one there that will rocket you to success!

FutureTimeline.net at www.futuretimeline.net is "a speculative timeline of future history". Find a summary of this decade's predictions at http://www.futuretimeline.net/21stcentury/2010-2019.htm.

TechCast's "Latest Technology Forecast Results" at http://www.techcast.org/Forecasts.aspx is "a technology think tank pooling the collective knowledge of world-wide technology experts to produce authoritative technology forecasts for strategic business decisions".

Have a great February - and don't forget Valentine's Day on the 14th!

Note: Copyright in this publication and its contents vests in LawDotNews(law.news)